Hi, I'm Emily Coltman, M for short, and this is one of my blogs. I'm Chief Accountant to FreeAgent www.freeagent.com . Views on this blog are mine personally though, and not FreeAgent's. I have strong views on good customer service, so in this blog I'll chat about anything and everything to do with customer service. I may also go off topic a bit and chat about general business matters. No stuffed shirts allowed.

Friday, 4 December 2009

Virgin took their time... but WiFi works a treat!

Thursday, 5 November 2009

Virgin says "computer says no"

WiFi on the train

Friday, 30 October 2009

Gold Star-bucks - and a raspberry for mobile broadband

3Connect mobile broadband said it wanted to download an update, so I let it... and what did it do?

Uninstalled itself, that's what.

Grrr.

And there was me with work to do and not time to drive the 10 miles home and back again to pick up the installation info.

So I guessed that a chain cafe would be my best option for WiFi and went round the corner to Starbucks.

They have WiFi. Good point. It's complimentary if you put £2 on a Starbucks card. Brilliant point.

So I registered for that.

And now it looks like I can use WiFi at any Starbucks I like (and there's plenty of them), on unlimited visits to Starbucks in the UK and Ireland (so long as I buy a drink at each visit of course), on any computer. It doesn't matter if I have my work Mac or my PC netbook with me. No software to download, unlike the 3Connect.

Looking good.

Wednesday, 28 October 2009

Winds of change!

So the content of this blog will change a bit going forward.

I'm going to keep away from writing about accounting software and other accounting matters here.

But I am still keen to write about customer service and so I'm going to keep this blog on to write about that.

I'm also going to start a new foodie blog, because my husband Matt and I love cooking and eating good food. And we also love checking out bed-and-breakfasts. So once I've decided on a snappy title for that blog, I'll put it up here.

Dennis Howlett would be proud of me - he had to give me a great deal of encouragement to make me take up blogging, but now I've started, I can't stop. It's addictive :-)

Monday, 28 September 2009

Multi-level application from Xero

Put simply, smaller businesses can now pay a reduced fee (here in the UK that would be £12 per month instead of £19 per month), but any customers paying that reduced fee can only enter 5 sales invoices per month, 5 purchase invoices per month, and 20 bank transactions per month.

And businesses that need multi-currency would pay £24 a month.

Reading the comments, I think these prices apply to new users signing up after 11th October 2009. Existing users would continue to get multi-currency as part of their package.

I'm not sure what I think about that.

In principle I'm all for paying for only what you need. It wouldn't make sense to pay for stock control if you're running a service-based business, for example. But I'm not sure I like how Xero have chosen to draw the boundaries.

Certainly I'm not sure that capping the number of transactions for micro businesses is a very good idea. Some small businesses would fit comfortably, for example a small IT contractor who has only 1 or 2 customers and sells his/her own services so has very few purchase invoices. But others would not. My own company quite often has more than 5 sales invoices to issue a month. I'd be snookered for the smallest plan if I were on Xero.

And I'm also not convinced that multi-currency is such an optional extra any more. Ask me a few years ago and I'd have said yes. But plenty more businesses now have customers abroad who have to be invoiced in their own currency. Not all overseas businesses are happy to be invoiced in £ sterling. I've had to issue 2 invoices in US dollars before now. That means I'd also be snookered for the medium plan on Xero. I'd have to pay £24 a month instead of £12. That's an extra £144 a year. Which, for a small business, is not to be (atishoo)* sneezed at.

Personally, I prefer FreeAgent's pricing structure, whereby the monthly amount paid is determined by whether your business is a sole trader, partnership/LLP, or limited company. It's 99.9% certain that a limited company will need to be able to produce dividend vouchers, and a sole trader won't - so they're in for a company and out for a sole trader.

Disclosure: FreeAgent is a customer of mine.

* Yes, I really do say "atishoo" when I sneeze. Honest.

Monday, 21 September 2009

Staff earning tips - did you know...

If you're working in a restaurant / bar / bistro, and tips are paid to you directly by the restaurant / bar / bistro's customers, you have to declare that income on a Self Assessment Tax Return every year and pay tax to HM Revenue.

But if your employer collects all the tips and shares them out between you and your colleagues, the employer has to operate PAYE on the tip money, so you don't have to worry about it.

And if someone other than your employer collects the tips and shares them out, that person may be a "troncmaster" who counts as an employer in his/her own right and so has to operate PAYE.

And the National Insurance gets even more complicated.

Crikey... and the bar staff are probably only trying to earn a few quid to help them get through university without a gi-normous student loan debt to pay off.

Why does it have to be so complicated?

Because declare any income tax-free and you run the risk of other income being falsely declared as that - and other complications. For example:

If tips were tax-free... then restaurateurs would pay their staff NMW (because they have to)... and anything else paid to staff would be classified as tips... and then the staff would have a job to get a mortgage because their P60 would show only a fraction of their income... and you're in a Gordian knot.

So in this case, perhaps it is easier to say that if staff collect their own tips, they must declare that as self-assessment income. But I hope that restaurateurs who let their staff do that, warn them that they have to do tax returns...

Tuesday, 15 September 2009

And here's why the tax system needs simplification

HMRC's website explains how much parents, other relatives, and anyone else, can give a couple when they marry, without the gift being counted as part of the giver's estate for Inheritance Tax.

What made my eyes pop was that the gift has to be promised "on or shortly before the date of the ceremony" to qualify for the exemption.

It can be paid over before or after the ceremony, but it must be promised before the ceremony or the exemption won't apply.

That astonishes me. What if, for example, an aged grandparent suffering from Alzheimer's Disease remembers only when the newlyweds visit her after the honeymoon that she hasn't told them about the money she plans to give them? That gift would not qualify for exemption.

It's also such a pettifogging little rule. I can't honestly see what difference it makes if the gift is promised before or after the ceremony, in logical terms.

But then, who said tax was logical.

Cut tax avoidance? Make the whole system simpler

In brief, Unite put the blame for the current recession squarely on the shoulders of the super-rich and big business who avoid paying their share of tax, then leave working- and middle-class families to pick up the pieces and bail out the banks.

They urge the government to close tax loopholes to prevent such large-scale tax avoidance, rather than cutting spending on public services.

I agree wholeheartedly with that. Cutting spending on public services would make unemployment worse in the short term because scores of public sector workers would find themselves out of work, and would damage the long-term economy, for the reason I've explained below.

At the moment we're seeing economic improvement, but that's only because money has been pumped into the economy. It's like an investor watching the share prices of a company rise and not realising that's only because he's bought a large block of shares.

For long-term economic recovery we need investment in public services, not cuts.

For example, it's education that can help people out of the poverty trap. Cut state education and you damage the chance of an intelligent child from a working-class background being able to achieve good exam grades, a place at university and a fulfilling and well-paid career. And that would damage the long-term economy, because that person, instead of having a well-paid job and paying more in tax as a consequence, could be forced to take a low-paid job and hence pay less tax.

Cutting public spending is not the answer.

Cutting tax avoidance is a much more satisfactory policy.

But I think that rather than a piecemeal closing of loopholes, it's time for the entire tax system to have a gigantic overhaul and be made much more simple.

As I meet with more micro-business clients of my practice, I come to realise even more that the tax system is cumbersome and so complicated that it's become impossible to run efficiently and easily.

Daily there are comments on Accounting Web about mistakes and inefficiency from HM Revenue. To that I say - HM Revenue is not the demon king. They are trying their best (at least the staff at the Cumbria Area, who are very friendly and helpful, are) to operate within a hugely overloaded, hugely complicated system.

We humans have made the world far too complicated for its own good.

To paraphrase a quote from the recent excellent BBC docu-drama about the collapse of Lehman Brothers - sometimes a return to an economy based on "goats and pebbles" seems very tempting.

Though I wouldn't recommend going that far :-)

Thursday, 10 September 2009

Fire an exam failer and lose staff loyalty

Most of the article focuses on the vitriolic e-mail he sent as he left, which has gone round the world.

Personally I'm less interested in that than in the fact that PwC fired someone who's obviously got a lot of spark and spunk, because he didn't pass his exams.

Whether those fails were at the first time of sitting or not isn't made clear in the article - but if they sacked him for not getting first-time passes then their policies are wildly askew. Because ACA exams are extremely tough.

I failed two of my ACA exams at first attempt (tax and audit). My then employers supported me through that time and helped and encouraged me to try again. On the second attempt I passed - and went on to qualify and, I like to think, to serve that firm loyally for 4 more years after I qualified.

Staff are not perfect beings. They are only human. I think it behoves an employer to help and support them, not trample all over them. It's by helping your staff when they need it that you receive loyal service.

Friday, 4 September 2009

Good service from a bad start

My netbook battery was dead so I plugged it into a convenient socket in the cafe.

When the waitress came to take the order, she spotted the cable, and said, "We're not meant to plug things into the sockets".

Being spoken to as if I were a naughty primary school child did get my back up a bit, and I wasn't sure what the socket was there for if it wasn't to be used :-) but I unplugged the computer, explained I couldn't work any more because the battery was dead, and offered to pay for the electricity if she would let me use the socket.

She got a bit flustered and said she wouldn't know how much to charge and they weren't equipped for computer use - so the answer was no.

I decided I wouldn't come to this cafe again.

But after she'd heard that and spoken to her manager, back she came to say OK, I could use the socket and she apologised but said she'd not encountered this problem before.

Up went my hackles a bit higher, I don't like being called a problem! But she quickly backtracked and said "not a problem". By this time I was starting to feel a bit sorry for her, after all she had fixed it for me to use the socket.

And then the manager came over to apologise too and say it really was OK, the reason why the waitress had wanted me not to use the socket was because "we drive them really hard to save electricity", and there would be no charge.

So now I'm perfectly happy to come here again.

They made a mistake but they were big enough to put it right.

And that the manager came personally to explain and apologise is a big plus.

So when I leave here, they'll get a generous tip to help cover the cost of the electricity. One good turn deserves another.

Thursday, 3 September 2009

Putting mistakes right

Sadly you have to be a member of AccountingWeb to read the full article (grr).

So I'd just like to summarise the tips here:

- Under promise, over deliver.

- Stay in touch with your customers.

- Go online.

- Personalise your service.

- Take responsibility.

I don't expect everyone - indeed anyone - who I deal with to provide me with a perfect service. That's just not possible. Everyone's going to make a bodge up now and again. We're only human.

What I do like is for people to sort out their mistakes.

My four principles of correcting a mistake:

- Admit it. Don't try and blag your way out of it or spin the customer a tale, (s)he can see right through you and isn't thinking much of you. And whatever you do don't blame someone else.

- Apologise to the customer.

- Explain to the customer what you're going to do in order to put the mistake right.

- And DO IT. Put the mistake right! No passing the buck and forgetting about it. If you have to ask someone else to correct it (e.g. your supervisor has to authorise a refund at the till) then make sure they do it!

Friday, 28 August 2009

Is it really that time of the year already?

While I can't agree with the violent way these campaigners are expressing themselves, especially as the shops in question are charity shops, I have to sympathise with their aim to contain the annual retail sales mayhem that is Christmas.

It's only the end of August now and people are already starting to mention the number of shopping days to go... information leaflets are appearing for Christmas parties at hotels and restaurants... I haven't seen any cards or wrapping paper in shops yet, but if it doesn't appear before the beginning of October I'll eat my hiking boots.

Let nobody say Bah Humbug. I love Christmas. But it's getting silly now. I heard a song once that said "Christmas comes but once a year and goes on for 2 months". These days make that 3 or even 4 months.

It's just madness. The amount of expectation, planning, and the sheer amount of money spent on food, presents and cards is astonishing. And that's fuelled every year by retailers hoping to cash in on the bonanza.

Call me Mrs Scrooge if you will, but I would like to see the following not start until 1st December, or 1st November at the earliest:

- Sales of Christmas cards / wrapping paper

- Piped Christmas musak in shops (which drives the staff, if not the customers, round the twist as they have to listen to it all day for weeks on end)

- Christmas decorations in towns, shops and house windows

- Encouragements to stock up on Christmas food

- Pester power adverts for children's Christmas presents

Tuesday, 25 August 2009

Would you follow a recommendation from a cold caller?

Personally I have to say that, as a small business owner, any telemarketers who call me, no matter what service they are offering, will, nearly always, be told very politely (after all, the poor devils are only trying to do their job), "No thank you".

If, exceptionally, they sound like the service is good, then I'll ask them to post me some more information. It's amazing how few of them will do that, particularly insurance salespeople. They want to get you signed up over the phone. No info by post = no sign up from M.

I would never use a telemarketing service to try and win more clients. Word of mouth and meeting people personally is proving to be far more effective. The personal and friendly touch can't be beaten.

Would you use telemarketers for your own business? How do you respond when a telemarketer calls you?

Thursday, 20 August 2009

Modern slavery, accounting style

I'm absolutely appalled.

As Dennis Howlett says:

As I read through the (long) post, I couldn’t help but feeling increasingly sorry for those left to crank out those 50-hour BILLABLE weeks – as confirmed by many commenters – and the veiled threat for those who 'fail':

That veiled threat, as quoted by Francine (my emphasis added):

After considering the various legacy practices we have decided that during this period, each professional when assigned full-time to a client project is expected to work and charge 50-hour weeks. This is simply a consistent national implementation of what used to be multiple slightly different regional models with the objective of generating at least the same outcome on average across our practice this year as we have had in prior years. We realize that many of you will take some personal time off in Periods 7 and 8 and so our expectations for those weeks - typically 1 week in November and 1-2 weeks in December will be different.

…If you schedule less than 50 hours a week your Talent Professional will contact you to understand your situation… begin consolidating your engagement resource needs as soon as possible taking the 50 hour week requirement into considerationYes, that does mean that staff at Deloitte are expected to consistently work an average of a 10-hour day.

That's terrible.

This shows why I never wanted to go into the Big 4. Despite the huge salaries and perks for staff, what good is a huge salary if you never have time to enjoy it, or when you do get time you're so brain-tired that all you want to do is sleep?

And that lays aside any consideration of whether the staff will produce anything like their best work under such conditions. When you're working that sort of long day (and let's not forget, that's 10 billable hours, not just 10 hours of being there of which 2 are admin), you'll be tired, you'll miss things, you'll make mistakes. What sort of service will that provide to clients?

I began my career in a blue-chip firm (not an accounting practice). I soon realised that working a 7-hour day was seen as skiving - and didn't last very long there. Because, quite simply, I wanted a life!

So I went to Cannon Moorcroft, a much smaller firm, run by friendly people, where the staff were looked after and treated like humans. My boss there caught me working late one evening on a non-urgent job, and shooed me off home.

When one of my colleagues went to join PwC, my mentor and I did our level best to dissuade her.

You can see why.

Tuesday, 18 August 2009

Polite customers lead to good service

Last night it was a lady who was taking her 2-year-old daughter, who had just recovered from a major operation at Great Ormond Street Hospital, to France to stay with her grandparents. Daughter, mother and grandparents were all flying to Nice together.

The snag was that the mother's passport had expired, because with all the worry over her daughter she'd forgotten to have it renewed.

The EasyJet customer service desk were extremely helpful. Believing that France doesn't permit travellers to arrive on expired passports, they tried to put all four passengers on a flight to a neighbouring country that did accept expired passports (Spain or Italy) from where they could travel to Nice.

The mother felt that this would mean too long a journey for her daughter, given the little girl's state of health.

So EasyJet rang the French immigration authorities and - with a little help on the French speaking front from the little girl's grandmother - the authorities agreed that, because of the special circumstances, and because the little girl had her own in-date passport, they would accept the mother on her expired passport.

The family - who had been very polite and apologetic to the EasyJet staff throughout - were almost tearful in their thanks.

I think this story highlights two areas.

The first is how important it is, as a customer, to be polite and respectful to customer service staff. Customer service team members are far more likely to go out of their way to help a friendly, apologetic customer who accepts they've made a mistake, than a bolshy, rude customer who expects staff to put right a mistake that wasn't theirs.

The second is the oft-made point that "going the extra mile" for a customer is what will get you remembered. That family will always be grateful to EasyJet for making the phone call and ensuring their much-needed holiday went ahead, and will tell the story to their friends.

Monday, 17 August 2009

Could reclaiming input VAT be simplified?

I think it can pretty much be summed up in three letters: V. A. T.

Otherwise it's largely a case of putting things in the right box, which can be simple or complicated depending on the business and what software they're using for the bookkeeping.

But when you have to worry about what you can reclaim input VAT on, it starts getting scary.

For example, if you've got a receipt for petrol, a packet of crisps and a newspaper bought at a garage, there would be VAT on the petrol and the crisps, but not the newspaper.

If you're working the VAT fuel scale charge, you can claim the VAT on the petrol.

But, strictly speaking, you can't reclaim input VAT on the crisps because they're not an allowable business expense. (I think the strict rules are that you can only claim food as a business expense if you're away overnight on business. HMRC say you have to eat anyway whether you're working or not.)

So as well as dividing up the receipt between motor (petrol), drawings/DCA (crisps) and either business stationery or drawings/DCA depending on whether the newspaper was for business or personal reading, you've got to divide up the VAT into what can and can't be claimed.

And all that for a receipt of under £100. Ow.

The VAT flat rate scheme would be helpful in this case, because when you're using that scheme there's no reclaim of input VAT apart from on large assets. So you don't have to worry about what input VAT you can and can't claim.

But only businesses with an annual VAT taxable turnover of 150,000 pounds or less [apologies - my computer hasn't got a pound sign!] can join the VAT flat rate scheme.

So, is it time for HMRC to simplify the rules for larger businesses as well?

Perhaps if the VAT that can't be claimed is less than 5% of the total VAT on that bill (as it would be in the above example of a tankful of petrol and a packet of crisps), then the VAT on the whole bill could be claimed?

I would imagine the amount of VAT revenue lost would be negligible and it would make life easier for businesses, particularly those with lots of travelling staff.

Tuesday, 11 August 2009

Business survival tips from Xero

There's a couple of points I'd like to draw out of the slides.

Slide 4, "Spend every dollar like it's your last", has as its second point, "Spend, don't hoard". I agree with that up to a point - but saving is not the same as hoarding, and saving is very important. I think it's always a good idea to make sure you have enough cash in a readily accessible bank account to pay important bills like wages, VAT and corporation tax.

Also on slide 4 is "Don't carry dead wood, it costs you", and that dead wood can be products, clients, staff or services.

That's very true. A product or service that won't sell, or a bad customer, or an underperforming team member, can be a real rotten apple in the barrel.

Time spent trying to sell a product or service that nobody wants is time that could have been spent making or selling something that your customers do want.

When you've spent time trying to help a bad customer, you often feel aggrieved, upset and cross, and then when a good customer phones up you're still in a bad mood - and that could rub off on your good customer. Bad news.

And we've all seen or heard stories about team members who don't pull their weight. The rest of the team then don't have the same motivation to perform, because they say "Well, she isn't, and nobody's pulled her up about it, so why should I?"

Slide 6 of Xero's presentation, "Get help", makes the very important point that you shouldn't try and do everything yourself when you're in business.

This is something I talk about on my other blog for home-based business owners, particularly in this article about legal contracts.

Remember Emma Jones's maxim - "Do what you do best, and outsource the rest!"

Tuesday, 4 August 2009

Virgin; you get what you pay for

Put it this way.

I travelled from Carlisle to London and back yesterday on a Virgin Pendolino train. (That's the new whizzy high-speed tilting train.)

According to the on-train info posters, of the nine passenger carriages of a Pendolino, four are first class.

That means only five for standard class.

So although standard class on a Virgin train is actually quite comfortable (decent seating, not too squashed, plenty of tables, not too few loos), by the time a train's worth of standard class passengers have squeezed into five carriages, it's less comfortable, and heaven help you if you haven't booked a seat. (I had.)

That says to me that Virgin are trying to encourage me to pay a bit more and buy a first class ticket next time I need to travel on a Pendolino.

And as that would get me some rather nice extras at no additional cost, like food and drink, WiFi, a newspaper, and a wider seat, I'm seriously tempted.

Duane Jackson's blog tells how he had to pay a lot more for Virgin to move his broadband than for BT - but with Virgin, he spoke to a human straight away and the arrangements were made within 5 minutes instead of 45.

Both these stories say to me that Virgin aren't looking for lots of cheap sales, otherwise they'd a) only have one first class carriage on a Pendolino, and b) use a push-button telephone system (yuck). They want fewer, more expensive sales, and they get them by boosting customer service.

Just a pity that Virgin had to take a lot longer to move Duane's broadband than BT do. That spoils their customer service a bit :-)

The hole in the donut

The article that Phil linked to is called Bookkeeping for Beginners.

It's a useful article but I'd like to add a few points and make a few suggestions to it.

Firstly - not all businesses need to keep ledgers, certainly not a purchase ledger. A one-man or one-woman business, selling its owner's own service, will almost certainly not need a purchase ledger. Put it this way, neither my video-making company nor my accountancy practice has a purchase ledger. No need to make your bookkeeping more of a chore than it already is :-)

Secondly - under the heading "Electronic bookkeeping systems" is the following:

Basic accounting software is more affordable than ever (budget £100-£180 inc VAT) and many deals come with free support. You could even set up a few simple pages in popular spreadsheet software, such as Microsoft Excel.Dedicated accounting packages are easy to use – even for those with limited know-how. Errors can be corrected quickly (which is more complicated when using manual systems), you get a snapshot of your cashflow at the click of a mouse (this is possible, although slower with a manual systems), as well as find out about money you owe and are owed. Handy financial reports can be gained at the touch of a button. You can also view sales patterns and costs, which can help with forecasting and budgeting.

Well, to me, there's a big hole in the donut there.

Why not recommend a few packages that small business owners can use?

Keeping your books on a spreadsheet can sometimes be a good idea, but why go to all the bother of setting up even "a few simple pages on Microsoft Excel" when there are purpose-built solutions that would do it for you?

I'll fill the hole with some recommendations for small business bookkeeping/accounting packages :-)

After the simplest and most user-friendly solution around for small service-based business that isn't planning to grow? Try FreeAgent.

Looking for a system that's suitable for most small businesses and has lots of features to turn on and off? Try KashFlow.

Starting small but planning to grow? Want something that not only does your books but helps you manage your contacts, customer relations, stock, website and lots of other things too? Have a look at Pearl.

Strawberry jam donut.

And while you're at it, donut folks, please don't make people register in order to post comments - that's just plain annoying :-)

Monday, 3 August 2009

Virgin wifi and Pret service

Travelled down on the train from Carlisle, and was impressed to see at the station a poster saying that Virgin offers WiFi on all its Pendolino trains. Great, I thought, no need for the dongle.

That was until I got to my seat and tried to log on - and found that the WiFi was only free for first class customers. For those of us in standard class, it's pay by the hour. Grrr. Especially given that the ordinary mobile connectivity on the train was sufficiently weak that my dongle wouldn't connect. Still, I managed to do what I'd planned, thanks to OpenOffice which I'd downloaded.

About half an hour ago, a tired accountant staggered into Pret a Manger in search of supper.

The staff are so friendly and welcoming. Always big smiles, calling me "madam", running to pick up a napkin I'd dropped. They make me feel like they're really glad to have me as a customer. Much more so than Virgin who made me feel faintly like riff-raff :-)

OK, time to wrap up now and go and catch my train home.

Friday, 31 July 2009

Who gives the best customer service?

Mick says to the FreeAgent team:

I hope you sell the company for an enormous fortune.Well sorry Mick, but I don't :-)

To my mind, the people who will provide the best product / service to customers are those who really love what they do.

And often, that's the people who started the company and for whom the product / service is their baby. They have the passion for it that nobody else can ever have.

So I don't reckon that we FreeAgent users will get any better from any other owner than we get from Ed, Roan and Olly, who've built a great product and provide very quick support.

I know, too, that Duane Jackson at KashFlow denies he's been tempted to sell out to Sage, and I think that's great because they just wouldn't have the passion he has for his product.

So don't sell up yet please guys :-)

I do wonder whether users of PTP accounting and tax software think the customer service is as good since it was bought by IRIS? Or whether TAS customers are still as happy since they've become Sage customers?

Monday, 20 July 2009

When customers won't help themselves

A lady flying from Bristol to Paris had had her flight cancelled because of a strike by French air traffic controllers. She transferred to the following day's flight, then turned up only 5 minutes before it left - and, unsurprisingly, was refused entry to check-in and told she'd have to pay a £35 transfer fee to fly the next day.

She was in floods of tears, insisting she couldn't pay, but the manager stood firm and insisted she had to pay because it was her fault she'd arrived late.

And, as Tony Robinson the narrator put it, "Oh look. She's found a credit card."

Breaking the rules for no good reason, and then trying to pull a fast one and avoid paying the fee, is, I'm sorry to say, is the sort of behaviour that makes businesses mistrust their customers - and sadly, that mistrust will extend to the good customers as well as the bad ones.

(I'd be pretty sure that the transfer fee was originally introduced to deter people from changing their booking at the last minute and causing a headache for the staff.)

Thursday, 16 July 2009

Software Satisfaction Awards 2009 - the shortlist

The Small Business Accounting Software shortlist contains not one, not two, but FOUR online solutions - and not a desktop-based package in sight.

That's right.

No Sage and no QuickBooks.

In fact, none of the "Business Accounting Software" award shortlists contain a Sage product. And I think this may be the first year this has happened (no doubt someone will correct me if I'm wrong). This year, Sage is up for only two awards and neither of those is in an "Accounting and Finance" category.

I think this is great news. It's an indication that business users are going online for accounting software and voting with their feet. I'm sure that Dennis Howlett would agree with me that we accountants have got to catch up and do the same or else we'll find ourselves floundering.

I'm also delighted to see that FreeAgent has made it to the shortlist in the Web Hosted Software category for what I think is also the first time. Great guns guys. And good to see KashFlow and Pearl both in there again.

I'll be watching with interest to see what happens on 8th October when the winners are chosen.

Tuesday, 14 July 2009

How rigid should staff hours be?

The staff get full flexi time. They can take an hour off at any time in the day.That's how it was at the practice where I qualified. Nobody minded if you went out for lunch at 2pm so long as you popped your head round the door and told the receptionist you were going then.

And that's great. Not only does it display a welcome level of trust in your staff, improves the partner-team relationship and encourages a relaxed and happy feeling to the working day, it also means that if you're right in the middle of something at 12 noon, you don't have to drop everything and go for lunch.

But, at the practice where I did some subcontract work earlier this year, they had set hours for staff lunches. You either went at 12 noon or at 1pm, for an hour. Which time you went was agreed with your manager. Any changes to that also had to be pre-approved by your manager.

So if you were due to go for lunch at 12 noon, and you were in the middle of a complicated VAT reconciliation which you wanted to finish and ended up not going till 12.15 - by default you'd lose 15 minutes of your lunch break. Stay out till 1.15? Not allowed unless you agreed it with your manager.

The two firms were very different. The first one was staffed largely by older, qualified individuals. I was 22 when I first went there and there were only two other team members anywhere near my age.

At the second, on the other hand, the accounts team was much larger, and its members were nearly all late teen or twentysomething trainees. At 31, and fully qualified, I was definitely an odd one out.

I guess that you do need to teach young staff good habits, like that staying out for longer than an hour at lunch-time is bad news. And the receptionist does need to know where everyone is in case clients phone - and with a big team, that's harder to manage flexibly.

But does it really have to be so rigid as the second firm had it? I'd be interested to hear what people think.

Friday, 10 July 2009

Is it time for a small business accountancy qualification?

In it, there's an article called "Future Stars" which briefly looks at the careers and aspirations of "11 accountants from business, practice and the civil service, whose career achievements indicate they have the potential to be future leaders of the profession".

I'm impressed that of these 11 accountants, only 4 are men, the rest are women, given that an earlier article in that magazine says that in 2008 less than 25% of chartered accountants were women.

I'm also awed by what some of them have achieved. One of the women scored 100% in one of her ACA exams. That's gobsmacking.

But what I'm not so sure about is that these are all big business accountants. They're from practices such as PwC, Deloitte, KPMG, BDO Stoy Hayward, E&Y. And multinational businesses and government departments.

And it makes me remember how, when I did my own exams, very little of what I learnt, particularly in the later stages, had any relevance to my job. The small business clients I dealt with would have known little, and cared less, about hedge funds, the present value of future cashflows, blah blah blah.

Is it time for a qualification that's tailored to small businesses, that focuses on issues that are relevant to individuals? It'd have been far more useful to me to learn how to run a payroll and learn about the various different kinds of statutory parents' pay available, for example, than to learn how to do merger and acquisition accounting.

But if that qualification were introduced, would the stuffier ACAs out there see it as a "poor relation"?

One letter-writer to this month's Accountancy has been scathing about the ICAEW's "fast-track" membership scheme for CIPFAs, ACCAs and CIMAs, who can be admitted to the ICAEW by certifying their experience.

She says:

Since I did three or more years of intensive study, tough invigilated exams and wide-ranging on-the-job training I feel that my qualification is being rather seriously undermined.Now I know nothing of CIPFA. But I've known ACCAs and did actually start my training doing CIMA. And those latter two qualifications both require "intensive study", "tough invigilated exams" and "wide-ranging on-the-job training". You can't become an ACCA or a CIMA without a great deal of blood, sweat and tears, any more than you can become an ACA.

The letter-writer goes on to say:

I do not wish to devalue the high-quality CIPFA, CIMA and ACCA qualifications.I'm sorry, but it seems to me that's exactly what she is doing - making them out to be "poor relations" to the ACA.

So if that's the prevailing attitude amongst ACAs and FCAs to members of other accounting bodies, then I can't see a small business accounting qualification being seen as any other than an extremely "poor relation".

So much though I think it would be an excellent idea, I can't see it happening.

Tuesday, 7 July 2009

Impersonal customer service? Wave your customers goodbye

She was worried sick because she was going to Edinburgh to pick up her children, then drive them down to Heathrow overnight, to catch their flight to go on holiday the following morning.

She protested that British Airways didn't require photographic ID for UK domestic flights (which is true - I've just looked it up on the BA website).

Her offer of a fax of her passport was refused, and when the check-in manager suggested she phone up her office, where the passport was, and have the passport couriered over, she said she couldn't afford it - nor did she have time to go home to fetch the passport, because her office was too far away.

In the end, she had to drive to Heathrow and get another flight with BA to Edinburgh. She left in floods of tears saying "Thanks a lot, EasyJet" and I don't think she meant that gratefully.

The EasyJet website does say:

All passengers to provide a valid form of photographic ID at check-in on all flights, including domestic services.But that is fairly well buried in their website. Is a busy mum of three going to have time to delve through the website and find it before she goes?

Now maybe I'm too soft. And I know airlines have to be ultra-careful given the terrorist threat. But if I were EasyJet, I'd have handled the problem differently.

Why not offer to pay for the passport to be couriered over? Then instead of sending away a very unhappy customer who'd be very unlikely to book again, you'd create a "wow", the customer would be overjoyed and relieved, and it'd be well worth the cost of the courier in repeat business from that lady and her friends.

Or, why not accept a faxed passport if the fax is certified by a professionally qualified individual such as a solicitor, a teacher or an accountant? That's what banks do when accounts are opened.

Then you'd have to set clear guidelines for under what situations you'd do that. Once and once only for any customer? Only if there are extenuating circumstances, e.g. children involved?

But a blank wall of a "No", particularly when it's shown on national TV, doesn't show the company in a good light.

Put it this way, I'm unlikely to fly EasyJet if there's an alternative, because the impersonal nature of its service - which I've experienced personally as well as a viewer of Airline - puts me off.

I loathe unreserved seating, for example. I hate being squished in the middle of a row. When I used to fly to Cornwall it was always with Flybe or Air Southwest where I could book a seat in advance and sit in the emergency exit row with more room for my knees.

When I have to fly EasyJet I always make sure I get there early so as to be one of the first on to the plane. But they scuppered that once at Newcastle by bussing us all out to the plane. The first people in the queue were squashed to the back of the bus and had no chance to make their choice of seats. Bleurgh.

Impersonal and rigid customer service is bad news and will put current - and potential - customers off.

Customers are individuals with individual needs and I think it's vital to treat them that way.

Monday, 6 July 2009

Different strokes for different folks, accounting-software style

For example, I'd never steer someone who wasn't either a highly skilled bookkeeper or a qualified accountant towards Sage 50. It's far too complicated.

I have two businesses - a limited company and a sole trade - and I keep their books on two different pieces of online accounting software. The company's on Pearl, the sole trade's on FreeAgent.

Both of these products are suitable for different kinds of businesses.

Pearl has a free version called Express for start-ups and micro-businesses. But, given the layout, look and feel of Pearl, I would say that this is aimed more at businesses that are starting small but are aiming to grow. The scope of Pearl is broad. There are lots of different menus and options within the software.

FreeAgent, on the other hand, is aimed fair and square at freelancers, consultants, and other micro-businesses that have started small and mean to stay that way. It's much simpler to navigate, because it has much fewer menus.

So before you choose your software, or choose what you're going to recommend to clients, think about whether the business plan is to stay small or to grow.

Wednesday, 1 July 2009

Timesheets - mark 2

Two commenters were in favour of "trashing the timesheet" pace Ron Baker, the other was not. Ali said, in answer to my point that there would always be "fudging" with a timesheet and that they take time to fill in:

I wouldn't think the fudging would have a significant impact on results. Getting minute-by-minute detail would be counter-productive if you're trying to foster efficient working habits.To answer that, I'd like to quote again from Hugh Williams, this time from his book "Life Without Timesheets; The Freedom to Charge what you are Worth".

Let's face facts; we make up a very great deal of what we put on our timesheets.Some practices get round this by charging time in 5 minute blocks. But to that I say - OW. As far as billing goes, that's so petty it's untrue. I hate it when I know a solicitor is doing that to me.

If you don't accept this accusation, then let me put something to you. For the last hour you have been working on client A's affairs but, during that time, not only did Client B telephone you to ask if he has to pay his latest tax demand straight away, but your fellow partner also called in to ask you if you saw that great programme last night on TV - and you went to the loo.

Now you may have a policy of not charging less than 1/4 hour for any work you do for a client, and if you follow this policy you will end up charging 1 1/4 hours for just one hour's work - 1 hour to client A and 1/4 hour to client B. But in fact you worked for less than an hour, if you take account of the loo break; yet you charged your clients 1 1/4 hours. This is wrong. The clients know we do this and they hate us for it.

And as for the effect on your staff, having to account for every 5 minutes of your day is what you do to primary school children.

I simply can't see a fair way to record time (fair to the clients, that is). If anyone else can, please comment.

Monday, 29 June 2009

Multi-tasking and the phone

I agree 100% that trying to do too many things at once is a recipe for making mistakes.

Carol mentions setting aside "batches of time" to deal with e-mails, texts and phone calls, and otherwise switching those devices off.

As far as e-mails and texts go, I agree. With phone calls, it's a little bit trickier. Accountants have a bad name for hiding in little ivory towers and being inaccessible to their clients.

But I can remember days at work when I'd be right in the middle of working something out, or writing a report, or doing some research, ring ring would go the phone and a cheerful receptionist would say "It's xxx for you, Emily".

And while I talked to xxx, my train of thought was interrupted, and I'd have to go back and start again once I'd got off the phone.

But that same receptionist's voice would, as if by magic, drop 10 degrees if I said "Could you take a message please, I'm in the middle of something".

So I think that one system a practice should have is that all staff, not just the partners, should be able to ask the receptionist not to put any calls through.

BUT - and this is very important - any messages taken should be followed up promptly as soon as possible. Otherwise the clients feel ignored and unvalued which is very bad news.

Friday, 26 June 2009

Mark Lee on timesheets

I've encountered that accountant mentality before now. I knew one accountant who billed his client for time spent at a social lunch. Yuk (that's the accountant's attitude, not the food).

David Winch comments to Mark's post;

What else could you do to reduce the downsides of your timesheet procedures?

Bin them!

I agree with David! My new practice has no timesheets (though when I do subcontract work for other accountants, I do a mixture of hourly rates and fixed fees).

If I were a client, I wouldn't want to wait a whole year before I knew what my accountant was going to charge me, and have no option to say "No thank you, that's too expensive" before (s)he did the work.

When you take your car in to be serviced, don't you like the garage owner to tell you upfront how much a standard service will cost?

If you send your children to private school (OK, I know that's a red rag issue for some people), how would you like it if the school charged more the longer it took to explain a problem to your child?

Filling in a timesheet is a job I always hated, and now I get to choose, I do as little of it as I can!

To quote Hugh Williams:When accountants and solicitors charge by the hour

Clients moan about fees and relationships sour

So throw away timesheets - Fix Price all you do

Bill 'em upfront and clients will love you!

Tuesday, 23 June 2009

Fast expenses on FreeAgent

One area where traditional desktop-based accounting software scores over online accounting software is the speed of data entry.

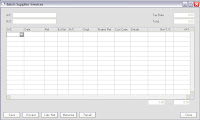

Accountants and bookkeepers are used to batch input screens, like this one (Sage's purchase invoice entry screen) where all the entries for a year can be made on one screen at one go.

Online accounting solutions often can't provide that, so each entry has to be made one by one, which can slow the process down.

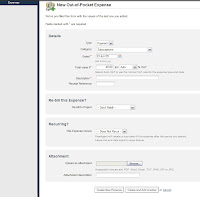

I've been looking at FreeAgent recently, and was impressed with how fast I was able to post out-of-pocket expenses into that system.

For starters, out-of-pocket expenses are set up as standard. No need to enter a bank account or supplier account for the director.

For starters, out-of-pocket expenses are set up as standard. No need to enter a bank account or supplier account for the director.Secondly, FreeAgent remembers the detail of the last entry (account name, date and amount), which is handy if you're recording repeated expenses like train tickets. What's even more handy for that is the recurring expenses feature.

And right at the bottom, you can choose to "Create and add another" expense. No need to go out of the expenses area and back in again.

So although this may not be as quick as a batch entry screen, I would say it's fast enough to at least start counterbalancing that advantage of desktop software, when you consider the myriad other advantages of online software.

Thursday, 18 June 2009

A new blog for M

But I've decided, because the blog content for clients and potential new clients would be so different from what I write here (this blog is either about videos or in accountantese), to set up a new blog to run beside this one.

The new blog is here and is for home business owners who are worried about the money and tax sides of their business.

My vision is to take that worry away by helping them.

Wednesday, 17 June 2009

The best things in life are free... but what about business?

Even though there's no audio, the message does come across clearly - don't be afraid to charge your customers for your product.

Or as Paddi Lund puts it, "When you ask your customers for money, don't be modest, and don't be embarrassed."

I've heard the phrase somewhere, "reassuringly expensive". And I think it's a good one.

If you know your product, and the service that comes with it, are good, then what are you doing charging EasyJet prices for it?

EasyJet is a no-frills airline. Passengers expect to pay a low price for tickets because there's no reserved seating (get to the front of the queue if you want an emergency exit seat and pray they don't shuttle you out to the plane in a bus and mess up the queue order completely - no kidding), no free drinks and no free food.

So it follows that if you charge a low price, your customers will expect a low-quality product.

Mercedes cars are expensive because the brand has a strong image of quality, reliability and elegance.

Are you a Mercedes or an EasyJet?

MindBites = MegaBrilliant

Then one of the MindBites team asked me if I'd like a purpose-built site to host my videos, as there are now quite a lot of them there. They're trialling customer specific sites so the cost would be £nil.

I figured "it's worth a try" and said yes please.

Within seconds this had appeared.

Wow.

Without any input from me, they had read my main website and used the same colour scheme, banners, even my logo. And put relevant text on the site.

I'm very seriously impressed with the speed, quality and responsiveness of their customer service.

Thanks MindBites.

Tuesday, 16 June 2009

New videos available: Really Simple Bookkeeping

Sage and QuickBooks are far too big for a business that's only got a few transactions a month at most.

And while there are excellent solutions out there like FreeAgent and KashFlow, for some very small businesses (I'm thinking along the lines of up to 10 transactions a month) even they would be overkill - and some business owners are worried about putting accounting information on the Internet, despite the level of security that SaaS products operate.

So I've decided to build a short video course on "Really Simple Bookkeeping" which shows owners of really small businesses how to keep their records easily on a basic Excel spreadsheet.

And I've also included .pdf instructions and downloadable copies of the spreadsheet in Excel 2003 and Excel 2007 formats in the price of the course.

To preview any or all of the videos, or to buy your own copy, please click here.

Monday, 15 June 2009

Sage Tricks for Accountants videos now on MindBites

Here's why I've decided to move them:

- You can now preview any or all of the videos before you decide to buy them.

- The videos are now all available individually as well as in one unit, along with a fully illustrated .pdf document for each video, so that you can save the content and look at it whenever you need to.

- If you do decide to buy all 8 you get a 25% discount.

I learnt these the hard way.

You don't have to!

Wednesday, 10 June 2009

In the top 5!

I had the winners' list this morning and although I didn't win a prize, my video was one of the 5 finalists. Which I'm chuffed to bits with, given I've only been in business 6 months. :-)

And that also means I can now share my competition entry with you again. So here it is - how to create a simple macro in Excel 2007.

Saturday, 6 June 2009

The ethics of the low-salary high-dividend route

This is of course perfectly legal. It rewards the owner-director for both the work they do (salary) and the risks they run in owning the business (dividends), and who's to say how much the individual should receive for each. And it's highly tax-efficient, because there'll be little if any PAYE and NIC due on the salary, and even though dividends come out of post-corporation-tax profit, there's no NIC on them, of either kind.

And I have to admit, in all honesty, that I do it.

But I can't help a feeling in my stomach that while this complies with the letter of the law, it doesn't comply with the spirit of the law? Is this how the system is designed to operate? Were small companies, and their directors, really meant to pay so little tax and NIC?

Richard suggests that small businesses should be run as LLPs rather than Ltds, so that the low-salary high-dividend route is closed. But that's not an option for one-person businesses like mine. To start an LLP you'd need a business partner.

The only other option, if you're in business alone, is to be a sole trader, in which case you lose the protection of limited liability. There's no such thing as a LLST.

Part of me says that if the Treasury felt that low-salary high-dividend was a real problem, they would close the loophole by extending National Minimum Wage legislation to all company directors, or putting NIC on dividends from close companies.

After all, the situation has been on-going ever since the 0% tax rate on all small company profits under £10,000 was introduced in April 2002, just before I sat my finals. Dozens, hundreds, of small businesses incorporated to save tax. And even though the 0% tax rate is a thing of the past since April 2006, over three years ago, there's still a distinct tax advantage to trading through a limited company, because there's no NIC on dividend income.

For me this is a real ethical conundrum. I'd be interested to hear what others think of it.

Thursday, 4 June 2009

The Google Mail glow

So I registered a domain www.homebusinessaccountant.co.uk* with 123-reg.

Then I decided to try their webmail to read my e-mail on info@homebusinessaccountant.co.uk.

I'm afraid I wasn't very impressed.

When I opened a new message, it hung for ages. Several times I had to forward messages to my Google Mail account before I could actually read them.

The final straw was with the joining messages from WiRe, Women in Rural Enterprise which it wouldn't even open. It said something about "a measure of data" I think. Bleurgh.

So I set it up to forward to my Google Mail account and set the Google Mail account up to receive it.

And Google Mail went and picked up all the old messages, as well as receiving any new ones coming in. Brilliant.

Now all my business messages come into Google Mail and I can reply with either of my addresses.

Cool.

* My website isn't live yet - hence there's no link here yet. To be updated.

Wednesday, 3 June 2009

The Revenue do it better

But in one respect, they deserve a gold star.

That's how they let anyone file a Tax Return online, using approved third party software, so long as the filer (not sure that word exists) has the right reference number.

And a Return can be filed on someone else's behalf, too. So I can file Tax Returns for my mum and dad without having to go through the giant holding bay that is the 64-8 submission process.

Companies House, on the other hand, deserve a slap with a wet fish for being in the Dark Ages.

To file accounts online with them, you have to download and fill in their abbreviated accounts template. That's after you've already spent [put in the number of hours here] completing accounts using third party software like IRIS, Digita and VT (my own favourite).

And, you can only do that if you know two different codes for the company, as well as the company's number.

I guess an extra layer of security is a good idea because company accounts are on the public record, which Tax Returns are not.

But does the process have to be so laborious? Surely, if HM Revenue can approve third party software for filing Tax Returns, Companies House could do the same for filing company accounts?

P.S. I tried downloading the accounts template for my own company. That was about 20 minutes ago and the page has stuck. Maybe it doesn't like my company because the next accounts filing date is in the future...

Tuesday, 2 June 2009

Crunch it up

From their website, Crunch reads as an end-to-end SaaS and accounting service for small limited companies, up to year end accounts.

There are several features of the system which sound great. For example, an automatic text message when a customer pays you.

But what the Crunch website doesn't explain (or if it does, it's well hidden), is who does the company's and directors' tax returns, and whether they're included in the monthly fee. Accounting doesn't stop at accounts.

Also, there's no demo of the software that I could find, neither a video nor access to a demo account. I'd have liked to see what the software looks like.

And Crunch seem to be doing all they can to encourage sole traders earning over £25k per annum to go limited.

Yes, that will save tax. Yes, that will give the benefit of limited liability.

But it does come with its drawbacks.

For one thing, if you work from home and want to keep your address private (i.e. not have to put it on your website / e-mail signature / business cards), there's no doing that if your business is a limited company.

For another, you have to understand the concept that you and the company are two separate legal entities. Any sales the company makes is money that belongs to the company - not to you. You can't take money out of the company as freely as you can from a sole trade, which is legally the same entity as you.

So what's my verdict on Crunch? I'd have to know a bit more before saying that. And I guess they're not going to put the negative side of being a Ltdco in their marketing - but I hope they warn customers of it first...

Paddi in the UK!

For anyone who's not heard of Paddi - he's an Australian dentist who also has some fantastic ideas about business.

How many dentists (or other businesses for that matter) do you know who'll only take on new clients if they're referred by a chosen existing client?

Who keep the front door locked, and sawed up the front desk (and replaced it with a cappuccino machine)?

Who offer their clients tea or coffee in bone china cups, and freshly baked Dental Buns, in their own personal space in the surgery?

And yet... Paddi's working week is only 23 hours and he still makes lots of money... and most of his customers love paying him.

No that's not a gag. I've spent a lot of time recently working with Paddi's material, and there's a large part of me that says "This might just work!"

And some of the points he makes really make me sit up and say, "Yes, that's true!". Like when he says:

An explanation given before the problem occurs is a reason. An explanation given after the problem occurs is an excuse.Paddi has not only written 6 books, he's coming to the UK and Ireland this October to deliver workshops and seminars about how he built his business - and share how businesspeople here can do that too.

I'll be attending the Birmingham seminar. And I'd urge anyone who can, to come along to one of the seminars too. I've seen a video of Paddi presenting and he's a great speaker - fun, lively and interesting.

Hope to see you at the seminar.

You are the boss... eh?

These describe (and illustrate) a workplace problem and then give three possible solutions.

Here's last week's problem:

One of your staff prides herself on her punctuality, arriving 5 minutes early. However, she is in the habit of eating breakfast when she gets in, then finishes her makeup, and by the time she has checked her social networking, she is the last to start work. What do you do?And the suggested solutions:

a) Enforce strict adherence to contractual start times - for all staff.The given correct answer was a).

b) Reschedule meetings to breakfast time and get the team starting work with the most important meal of the day.

c) Clear the kitchen before she arrives.

But I disagree. My correct answer would have been "none of the above".

I'd have said that the manager should have taken the errant member of staff aside for a quiet word with her alone.

a) would create a bad atmosphere in the office for two reasons. The punctual team members get upset because they feel they're being picked on even though they've done nothing wrong, and the lady in question would probably think "this doesn't apply to me" and carry on exactly as she has been doing.

What do other people think?

Update: Always read the small print

Oops.

And no wonder I couldn't find that anywhere else on their site.

They've put it right now in the guidance notes, after I pointed it out to them.

Friday, 22 May 2009

Today's tip: Always read the small print 2 (good news)

That form is short, clear and well written.

It comes with a thicker "Accompanying Notes" section, which I nearly decided I didn't have time to read.

Cue Captain Bertorelli - "Mamma mia. What-a mistake-a to make-a".

Hidden in the notes was a paragraph saying that there's an exemption from paying the £253 fee for the first year or so of practice, available to be applied for, by sole practitioners who either haven't had a practising certificate in the last 3 years, or haven't applied for the exemption before.

I like the ICAEW.

Another good reason why you should always read the small print.

Doing that today has potentially saved me over £600 for the next year. Which is a lot when you're a one-woman start-up business.

I think I'll spend the money I save on a nice website for my hopefully-soon-to-be-new practice.

Today's tip: Always read the small print 1 (bad news)

That's one reason why I've decided it's time to bite the bullet and set up my own accountancy practice, so I can have my own accounts and tax clients as well as making videos. Which in turn means filling in a lot of forms. Including applying to the ICAEW for a Practising Certificate without which I can't take on any paying clients.

I wanted to have a nice snappy virtual office address (because I work from home) and move my company's registered office address there. I found a business centre local to me, which offers virtual office services, and asked them if that was OK. They said yes, and promised to put the forms in "tonight's post".

That was Tuesday. The forms arrived today. And the postmark was yesterday (Thursday). Black mark.

And when I read the small print, not only were they asking for references from a previous landlord and from the bank (for £30 a month - I ask you!), but it said "thou shalt not use our address for thy registered office".

I rang to ask.

They checked and said it's illegal to use a virtual office as a company's registered office.

I didn't know that. Thankfully I found out before paying any money over. But I wish they'd checked when I first asked :-)

Tuesday, 19 May 2009

Online accounting for accountants: Benefit 2

What if you've also got clients who use lots of other programs? So as well as Sage, you've got clients on QuickBooks, TAS, Cashflow Manager, and maybe one or two on MYOB thrown in for good measure.

Then what happens if your clients get stuck and need help posting a transaction?

Do you have staff in your office who know their way round all those packages, and can provide telephone support for your clients?

Or do your clients have to sign up to additional, expensive, support cover from the software provider, because you can't help them?

And then what happens at year end, as your staff struggle to extract meaningful information from a program they're not comfortable and familiar with?

I can tell you what happens - you get an angry, frustrated team member and a lot of time to write off.

It may just be my own experience. But the online accounting packages I've seen all have support bundled in as part of their monthly fee. Nothing extra to pay.

And many of them, as well as written "help manuals", have extra, free, Help features.

FreeAgent uses a GetSatisfaction forum so that users can swap ideas and tips. KashFlow has a "send us a query" feature that's always been very quickly answered when I've used it.

But the best Help feature I've seen so far belongs to Winweb, who have 24-7, live, instant, chat support available. Jason Holden tells me that's even operational on Christmas Day.

So, for better support and help for your clients and staff, the online packages take the medal.

Friday, 15 May 2009

Online accounting for accountants: Benefit 1

Do you have clients who keep their records on desktop software?

How easy is it to switch from one client to another?

Let's say you've got clients on Sage. Some of them use Sage Instant. Some use the old-style Line 50 in all colours from version 10 onwards. Some use the new-look 50 Accounts.

So if you've finished looking at one client's books and want to look at another, you've got to close the program you've got open, remember which version the second client is on, open that program, restore a backup... and umpteen clicks of the mouse later, you're there.

BUT... if your clients all kept their records online, using the same system (whatever that may be), then just about every online accounting software program I've seen has a facility to switch quickly from one client to another.

Pearl does. Winweb does. I think FreeAgent does, too.

So no more faffing about changing from one different version of the same product to another.

Wouldn't that save you a lot of time?

Thursday, 7 May 2009

MindBites screencast competition

I've entered two videos for it; the video on how to record a simple macro that you can see on this blog, and one of the videos about pivot tables that I made for Glen Feechan.

If you'd like to vote for either of these videos, please click the button below.

Thanks very much!

Friday, 1 May 2009

Sample from Sage Tricks for Accountants series

Why do accountants put themselves through it?

We both agreed that we'd got a wardrobe full of T-shirts saying something like "I've prepared accounts from crap records", and wishing we dared to turn up to the ultra-posh Accountancy Age awards dinner in November sporting one of these T-shirts apiece.

What I don't understand is why accountants put up with being presented with crap records year after year after year.

I remember one client back down in Buckinghamshire who kept his books on Cashflow Manager. Every month he put through an "adjustment" of several thousand pounds to make his bank rec balance. Then, when we charged him a large fee to correct all his "adjustments", he would turn round and say, "But I've balanced the bank!"

Added to that, this guy was also a thoroughly unpleasant person who had been known to shout at the payroll team and swear at the partner.

Yet he was a long-standing client!

Just recently, I was working on another client's books.

An Excel cashbook - for a huge ironmonger's firm. It didn't agree to the bank. I had to spend hours ticking it back. The manager said they'd tried to get him to make his books better but to no avail.

"Then why is he still a client?" I asked.

"Because he'll pay whatever we ask him to!" she replied.

That may well be so. And I know there's a credit crunch on and fee-paying clients are a very valuable commodity.

Richard Murphy tells the tale of how when he was in practice, clients had 2 years to get their records up to his standard. After that, if they were still presenting him with rubbish records, he sacked them.

I admire him for that. It's what I wish - and hope - I'd have the guts to do if I ever set up my own practice. It's what I wish all accountants did. Because even in these hard times, there's got to be people out there who won't give you crap records if they're taught how not to.

I guess sometimes it's hard to do that with existing clients you've known for years and who have become friends.

But someone like the rude guy from Bucks should have been straight on the "please close the door after you" pile!

Thursday, 30 April 2009

FreeAgent; brief review

I was seriously impressed with the look and feel of the software. It's slick, smooth and with plenty of plain English explanations for end users.

That said, end users do need to be reasonably tech savvy. For starters, there's no function to key in the closing bank balance. Users have to import a bank statement. Great if you do online banking and are comfortable with exporting a statement from your bank's website. And these websites aren't as user-friendly as FreeAgent's. But I guess that anyone who's thinking of doing their accounts online will be OK with that.

For accountants who might be interested in signing up as FreeAgent partners, as BFCA (Blevins Franks) have already done, two features which really did generate a "Wow!" for me were:

- When a payment to a director/shareholder is entered, if the net wages journal has already been posted and there are some expenses outstanding, FreeAgent automatically divides the payment up between net wages and expenses and puts any balance as a dividend. And it produces dividend vouchers too.

- If a business changes from invoice accounting for VAT to cash accounting for VAT, or vice versa, FreeAgent automatically works out the adjustment for closing debtors and creditors. I've spent hours wrestling with Sage to work that out...

But I'd certainly add it to my list of software that I would recommend for small businesses, and in particular freelancers. Unlike other small business accounting software products, FreeAgent is very strongly focused towards that market. And having such a targeted focus means it's very, very strong in that area.

Monday, 27 April 2009

Sage Tricks for Accountants videos now available

Help is at hand.

I'm delighted to introduce to you a tutorial pack called "Sage Tricks for Accountants".

This is now available to buy at a special introductory price of £24.50 from my website here.

The pack contains 8 short videos as well as a set of .pdf tutorial notes for anyone who prefers the written word to watching a video.

For more information, and to get your copy, click here.

Friday, 24 April 2009

Who to pay first?

It's definitely worth a read. There's a lot of very sound advice there.

A comment from Sue Baker in the Spend Wisely section of the guide winked at me - because I realised that subconsciously I already do this.

Sue advises:

Prioritize your payments:Does 4. also include HM Revenue??

- Individuals/one-man bands. Don’t mess them around. Their livelihoods are at stake.

- Critical suppliers. You need these people.

- Local suppliers. Look after your local firms.

- National/international firms.

VAT rate change: big enough to be a nuisance, not big enough to make a difference

At the time I was working for More and it meant several all-nighters for the IT team to get the rate into the software and running smoothly.

Wednesday's Budget has confirmed that the rate will go back up again to 17.5% on 1st January 2010.

Am I the only one who thinks this change up and back again was a complete waste of time?

The cut is far too small to make any kind of difference to spending or pricing. But it's plenty big enough to cause a nuisance, like having to re-write price lists, edit a website, edit sales literature, etc.

Yesterday, I was preparing a set of accounts, and in order to work out a creditor correctly, I had to take 1 month at 17.5% + 13 months at 15% plus 10 months at 17.5%... what a faff.

Come on Mr Darling, have a bit of common sense!